Practice Free MB-310 Exam Online Questions

A customer implements Dynamics 365 Finance and wants to use the recurring invoice feature for accounts receivable.

The recurring invoice template includes the start date and frequency. However, when the Generate recurring invoices job processes, invoices are not created despite the criteria being met.

You need to ensure that invoices are generated.

What should you do?

- A . Associate a customer to the invoice template on the invoice template form

- B . Set the maximum billing amount on the recurring invoice template.

- C . Assign an invoice template to the customer posting profile.

- D . Assign an invoice template to a customer on the invoice tab of the customer record.

A client has unique accounting needs that sometimes require posting definitions.

You need to implement posting definitions.

In which situation should you implement posting definitions?

- A . when financial dimensions need to default from the main account onto an invoice

- B . when using encumbrance accounting for purchase orders

- C . when the system needs to automatically post a transaction to the accounts receivable account on invoice posting

- D . when creating one offset ledger entry based on transaction type

B

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/general-ledger/posting-definitions

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions.

The client has the following requirements:

✑ Only expense accounts require dimensions posted with the transactions.

✑ Users must not have the option to select dimensions for a balance sheet account.

You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry.

Solution: Configure one account structure for expense accounts and include applicable dimensions.

Does the solution meet the goal?

- A . Yes

- B . No

B

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/configure-account-structures

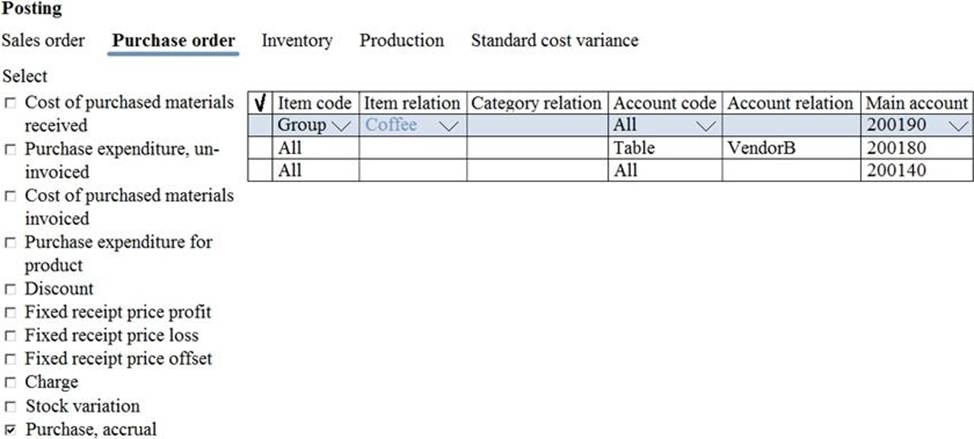

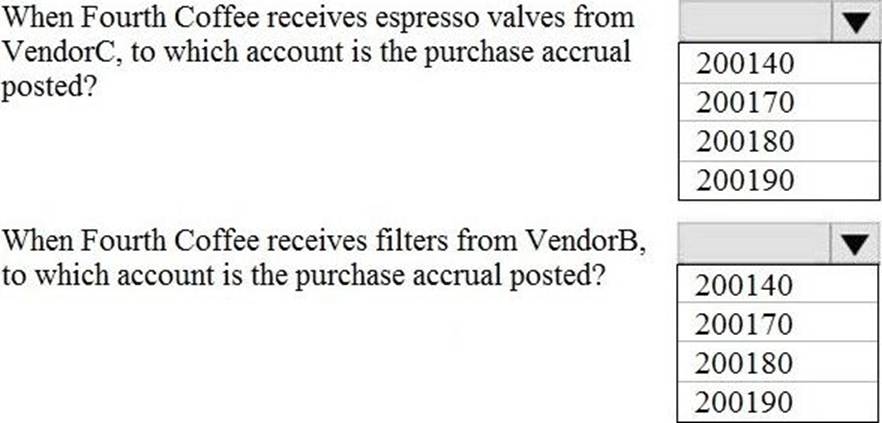

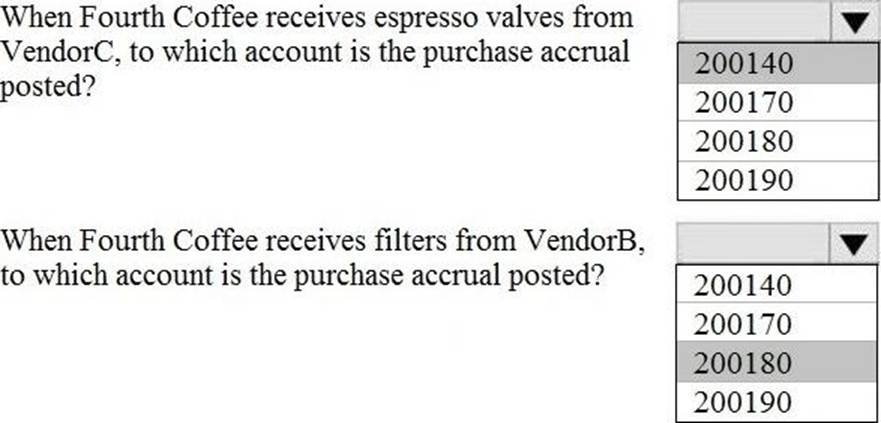

HOTSPOT

The posting configuration for a purchase order is shown as follows:

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point.

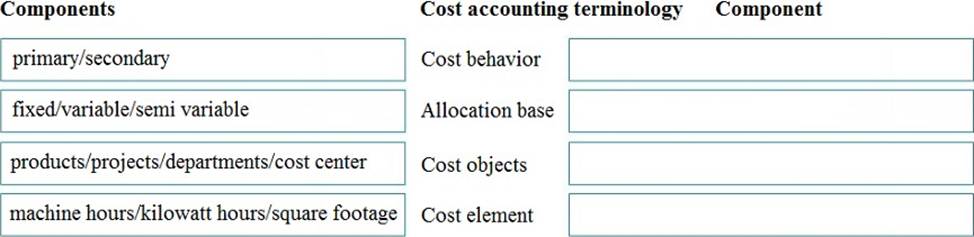

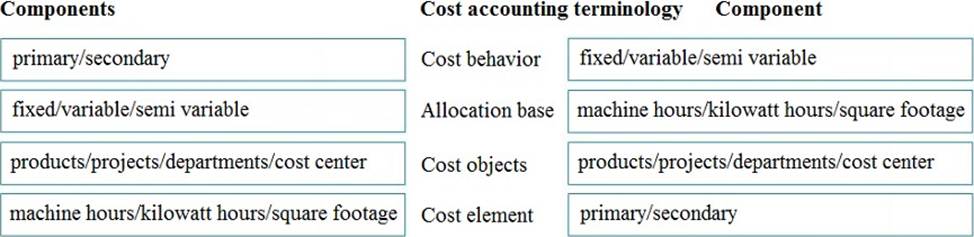

DRAG DROP

You are a controller in an organization. You are identifying cost drivers to see how changes in business activities affect the bottom line of your organization. You need to assess cost object performance to analyze actual versus budgeted cost and how resources are consumed.

You need to demonstrate your understanding of cost accounting terminology.

Which component maps to the cost accounting terminology? To answer, drag the appropriate component to the correct cost accounting terminology. Each source may be used once. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point.

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/cost-accounting/terms-cost-accounting

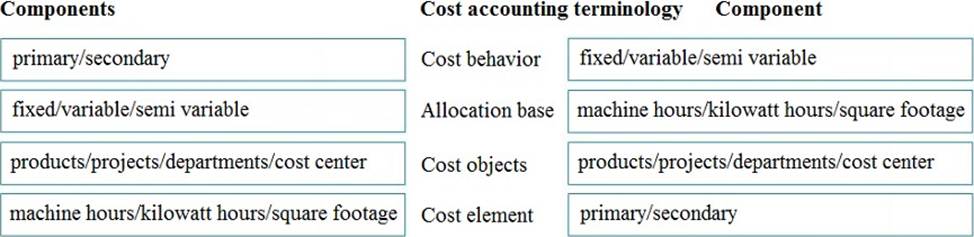

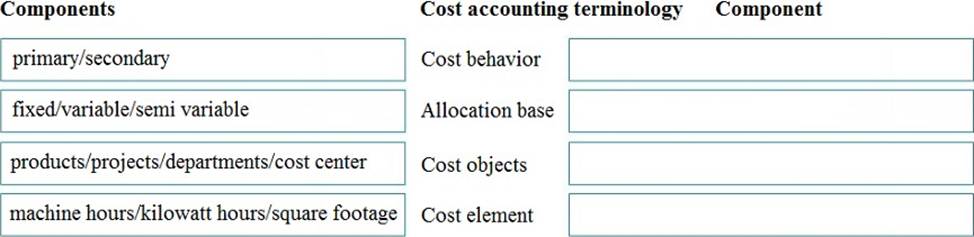

DRAG DROP

You are a controller in an organization. You are identifying cost drivers to see how changes in business activities affect the bottom line of your organization. You need to assess cost object performance to analyze actual versus budgeted cost and how resources are consumed.

You need to demonstrate your understanding of cost accounting terminology.

Which component maps to the cost accounting terminology? To answer, drag the appropriate component to the correct cost accounting terminology. Each source may be used once. You may need to drag the split bar between panes or scroll to view content. NOTE: Each correct selection is worth one point.

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/cost-accounting/terms-cost-accounting

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution. Determine whether the solution meets the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A customer uses Dynamics 365 Finance.

The controller notices incorrect postings to the ledger entered via journal.

The system must enforce the following:

✑ Expense accounts (6000-6998) require department, division, and project with all transactions. Customer dimension is optional.

✑ Revenue accounts (4000-4999) require department and division and allow project and customer dimensions.

✑ Liability accounts (2000-2999) should not have any dimensions posted.

✑ Expense account (6999) requires department, division, project and customer dimensions with all transactions.

You need to configure the account structure to meet the requirements.

Solution:

✑ Configure one account structure.

✑ Configure an advanced rule for Liability accounts (2000-2999) not to display any dimensions when selected.

✑ Configure an advanced rule for Expense account (6999) to require customer.

✑ Configure the structure with all dimension fields containing quotations.

Does the solution meet the goal?

- A . Yes

- B . No

B

Explanation:

Dimension fields containing quotations means that a blank value is accepted. This does not enforce a value being configured for the dimensions that are ‘Required’.

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/configure-account-structures

A customer uses the sales tax functionality in Dynamics 365 Finance.

The customer reports that when a sales order is created, sales tax does not calculate on the line.

You need to determine why sales tax is not calculated.

What are two possible reasons? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

- A . The sales tax group is populated on the line, but the item sales tax group is missing.

- B . The sales tax settlement account is not configured correctly.

- C . The sales tax authority is not set up for the correct jurisdiction.

- D . The sales tax code and item sales tax code are selected, but the sales tax group is not associated to both codes.

- E . The sales tax group and item sales tax group are selected, but the sales tax code is not associated with both groups.

AE

Explanation:

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/indirect-taxes-overview

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/set-up-sales-tax-groups-itemsales-tax-groups

You are a Dynamics 365 Finance expert for an organization.

You need to configure the Financial period close workspace.

Which three configuration processes should you use? Each correct answer presents a part of the solution. NOTE: Each correct selection is worth one point,

- A . Create templates that contain the required tasks within the closing process and assign to closing role.

- B . Create a separate closing schedule for every legal entity.

- C . Assign a ledger calendar to the closing process.

- D . Create task areas and descriptions.

- E . Designate resources and their scope based on closing roles.

ADE

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/financial-period-close-workspace

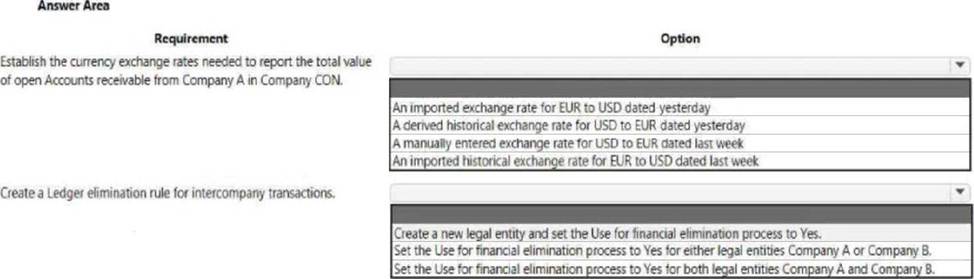

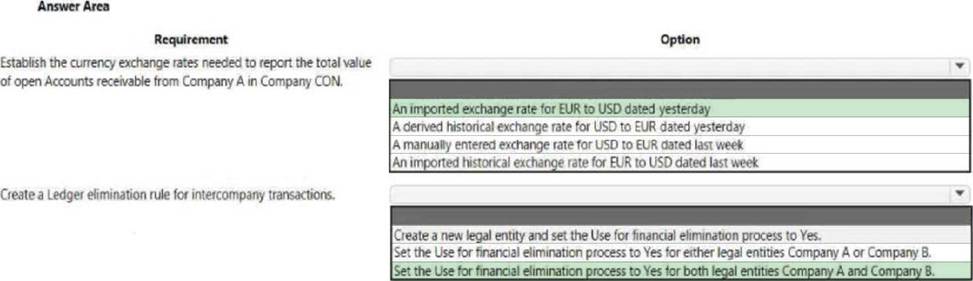

HOTSPOT

A company is implementing Dynamics 365 Finance.

The company must be able to record sales orders in the following currencies: USD. EUR, and GBP.

Company A uses USD as the accounting and reporting currency Company B uses GBP as the accounting and reporting currency.

Each company is consolidated into Company CON that uses EUR as the accounting and reporting currency.

Assets and liabilities are revalued at the current exchange rate.

You need to configure the system to meet the requirement.

Which option should you use? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point.