Practice Free MB-310 Exam Online Questions

A company uses Dynamics 365 Finance to include multiple business units as a financial dimension. All customer payment journals must be posted to the headquarters’ business unit financial dimension. You need to configure the accounts receivable journal name.

What should you configure?

- A . Journal approval

- B . Default financial dimension

- C . Posting restriction

- D . Journal control

You are the controller of a multi-entity organization that uses the same chart of accounts and fiscal periods across all entities. You use the financial report designer in Dynamics 365 Finance to create, maintain, deploy, and view financial statements.

You need to generate consolidated financial statements by using a building block group to aggregate data across companies and financial dimensions.

Which three actions should you perform? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

- A . Create a column definition that includes a financial dimension column for each company.

- B . Create a column definition and use the period and year to map the appropriate periods for each company.

- C . Create a row definition that includes all appropriate accounts in all companies in the rows.

- D . Create a reporting tree that includes a reporting node for each company.

- E . Use the Reporting Unit field to select the tree and reporting unit for each column.

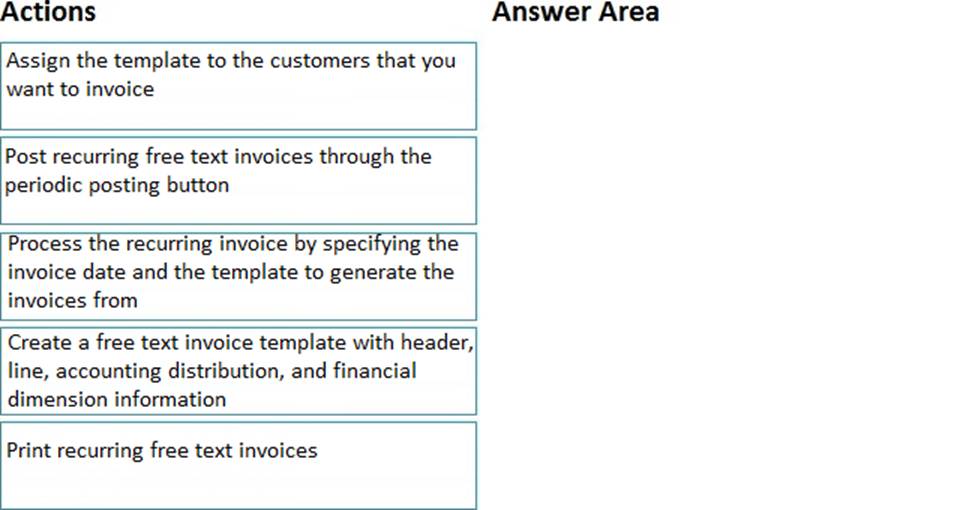

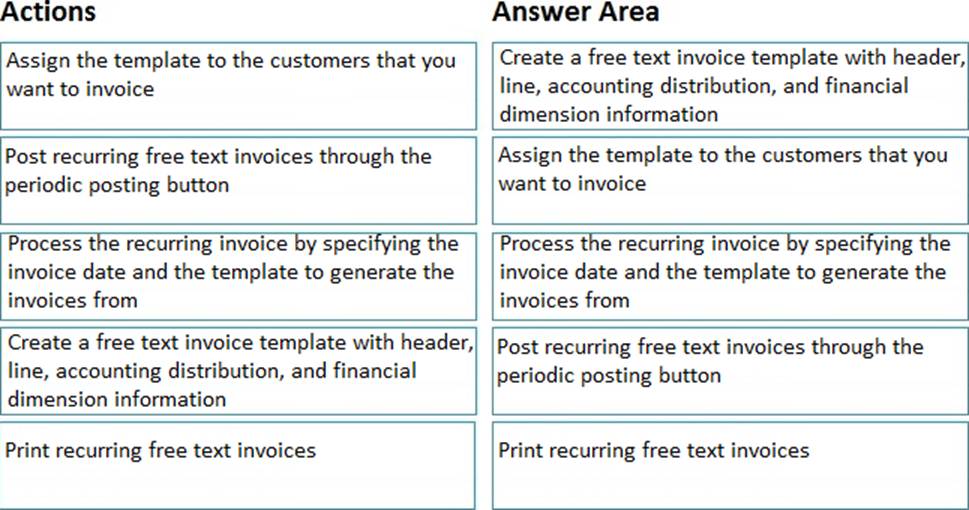

DRAG DROP

An organization sells monthly service subscriptions. The organization sends invoices to customers on the 15th of every month in the amount of $450.00.

You need to set up, configure, and process recurring free text invoices for the customers.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/accounts-receivable/set-up-process-recurring-invoices

A company uses Microsoft Dynamics 365 Finance. The company purchases, creates, and acquires fixed assets by using purchase orders.

The system must acquire the fixed asset when a vendor invoice is posted.

You need to process the transaction.

What should you do?

- A . Run a fixed asset acquisition proposal before a fixed asset number can be added to a purchase order.

- B . Manually create a fixed asset before the fixed asset number is added to the purchase order.

- C . Select a procurement category in a purchase order line and leave the fixed asset group blank.

- D . Leave the fixed asset number blank on the purchase order.

You are configuring the Accounts payable module for a company.

The company needs to set a limit on the charges they will pay for specific items.

You need to set up the limit for charges.

Which two actions should you perform? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

- A . Define the maximum charge amount on the vendor record.

- B . Enter the maximum amount when you set up the charges code.

- C . Use budget control with the specified charges code.

- D . Set the maximum charge amount in the Accounts payable parameters,

- E . Enable invoice matching validation in the Accounts payable parameters.

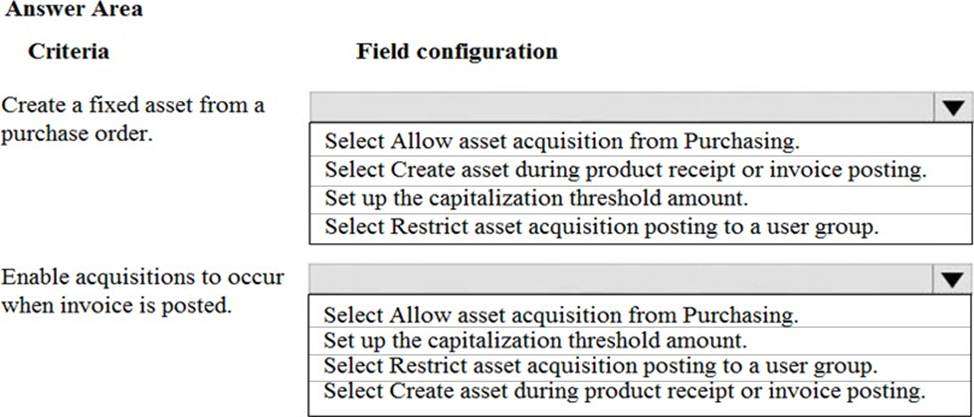

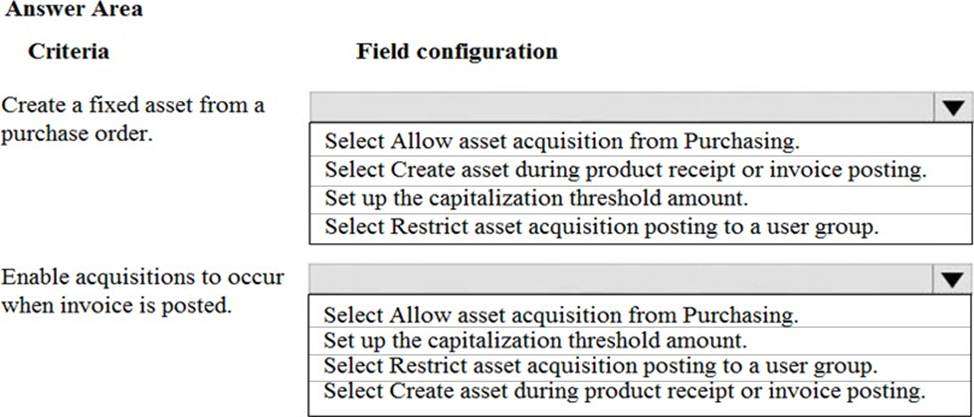

HOTSPOT

You are the purchase manager of an organization. You purchase a laptop for your office for $2,000.

You plan to create a purchase order and acquire the new fixed asset through the purchase order at time of invoicing.

You set up the system as follows: Fixed assets are automatically created during product receipt or vendor invoice posting and the capitalization threshold for the computers group (COMP) is set to $1,600.

You need to automatically create a fixed asset record when you post an acquisition transaction for the asset after you post the invoice.

How should you configure the fixed asset parameters to meet the criteria? To answer, select the appropriate option in the answer area. NOTE: Each correct selection is worth one point.

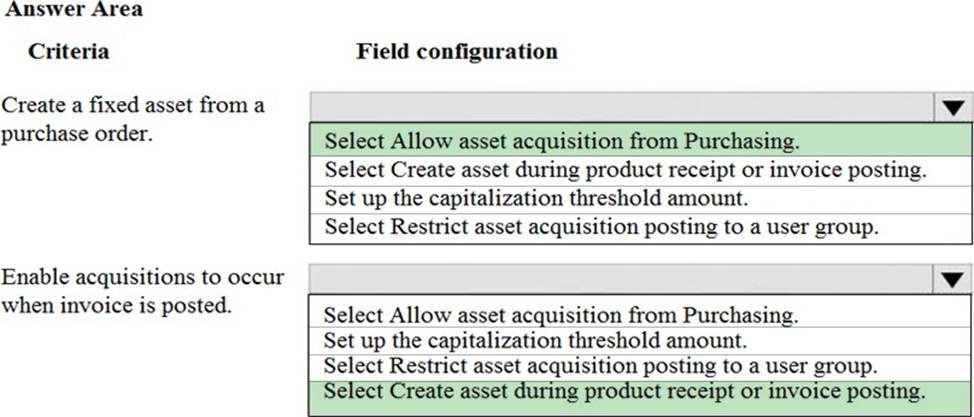

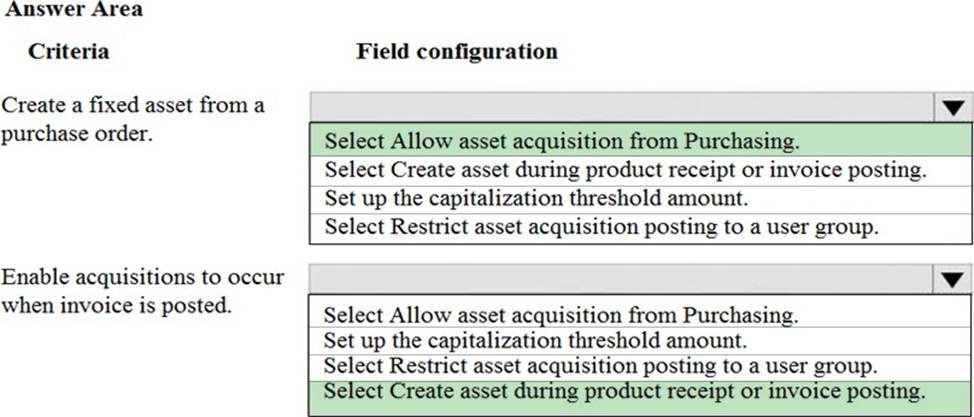

HOTSPOT

You are the purchase manager of an organization. You purchase a laptop for your office for $2,000.

You plan to create a purchase order and acquire the new fixed asset through the purchase order at time of invoicing.

You set up the system as follows: Fixed assets are automatically created during product receipt or vendor invoice posting and the capitalization threshold for the computers group (COMP) is set to $1,600.

You need to automatically create a fixed asset record when you post an acquisition transaction for the asset after you post the invoice.

How should you configure the fixed asset parameters to meet the criteria? To answer, select the appropriate option in the answer area. NOTE: Each correct selection is worth one point.

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has multiple legal entities set up in Dynamics 365 Finance. All companies and data reside in Dynamics 365 Finance.

The client currently uses a separate reporting tool to perform their financial consolidation and eliminations. They want to use Dynamics 365 Finance instead.

You need to configure the system and correctly perform eliminations.

Solution: Select Consolidate online in Dynamics 365 Finance. Include eliminations during the process or as a proposal. Set up the transactions to post in the legal entity configured for consolidations.

Does the solution meet the goal?

- A . Yes

- B . No

B

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/budgeting/consolidation-elimination-overview

A company manufactures and installs air filtering units for industrial manufacturing plants. The air filtering units are manufactured to order.

The com

• 25 percent at the time of the sale

• 50 percent when the unit is shipped

• 25 percent when the unit is installed

Additionally, a three-year warranty is sold with covers.

You need to configure revenue recognition.

What should you do?

- A . Create a reallocation posting for the warranty revenue.

- B . Create a new revenue schedule for each unit.

- C . Create the revenue schedule so that it uses the contract terms

- D . Create one revenue schedule with milestones.

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions.

The client has the following requirements:

✑ Only expense accounts require dimensions posted with the transactions.

✑ Users must not have the option to select dimensions for a balance sheet account.

You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry.

Solution: Configure one account structure for expense accounts and apply advanced rules.

Does the solution meet the goal?

- A . Yes

- B . No

B

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/configure-account-structures