Practice Free MB-310 Exam Online Questions

A company signs a four-year contract for an IT support project. The manager wants to know how the revenue amounts will be allocated across the four-year period. You need to implement a revenue schedule to determine the revenue amounts for each month.

Which setup should you use?

- A . 4 years

- B . 4 months

- C . 60 months

- D . 48 months

You are configuring budgeting components in Dynamics 365 for Finance and Operations.

You need to configure multiple budgets.

What are three budgeting options you can use? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

- A . Cost management budget, including Production and Resource groups

- B . Sales budget, including Campaigns and Events

- C . Workforce budget, including Compensation groups and Positions

- D . Project budget, including Items and Fees

- E . Ledger budget, including Revenue and Expense types

You are configuring vendor collaboration security roles for external vendors. You manually set up a vendor contact. You need to assign the Vendor (external) role to this vendor.

Which tasks can this vendor perform?

- A . Delete any contact person that they have created.

- B . Deny or allow a contact person’s access to documents on the vendor collaboration interface that are specific to the vendor account

- C . View and modify contact person information, such as the person’s title, email address, and telephone number.

- D . View consignment inventory.

D

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/unified-operations/supply-chain/procurement/set-up-maintain-vendor-collaboration

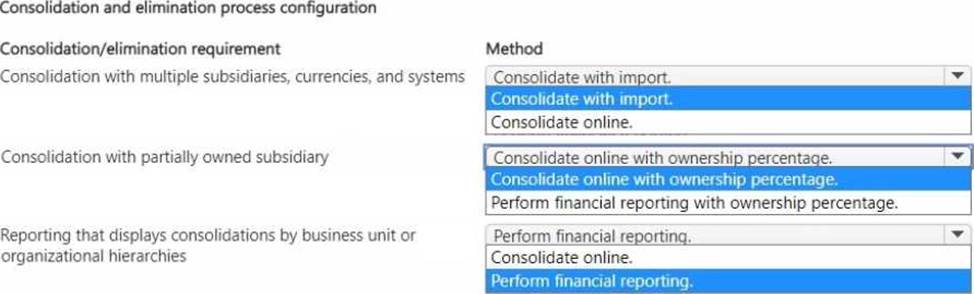

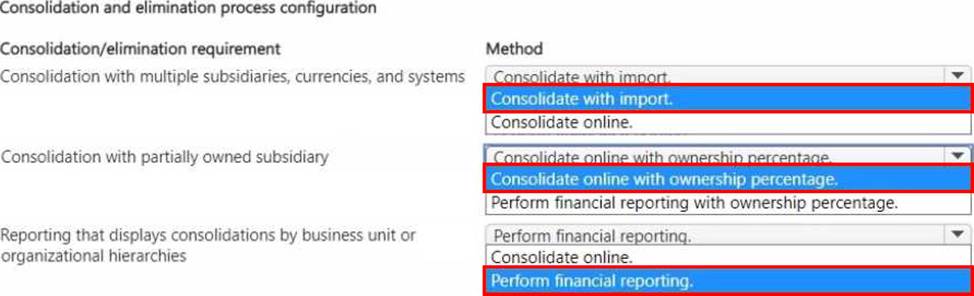

HOTSPOT

You manage the consolidation and elimination process in Dynamics 365 Finance for a company.

The company must consolidate financial data from multiple subsidiaries that use different currencies and systems. The company must ensure that intercompany eliminations are correctly processed.

You need to set up and run the consolidation and elimination process in Finance.

How should you complete the configuration? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point.

A company manufactures air filtering units few industrial manufacturing plants.

During the acquisition of one of the components that is used in the unit, an agreement is reached that the $25. 000 component mil be paid for in the following schedule:

• The first payment will be $10,000

• The remaining balance will be distributed equally and due on the 15m of the month for the next three months.

You need to configure the system for the payment schedule.

What should you do?

- A . Enter $25,000 in the Amount of Transaction Quantity field.

- B . Use the Specified allocation method.

- C . Set the Fixed allocation method Rued Amount field lot the monthly amount.

- D . Specify a fixed quantity payment of 5.

The controller at a company has multiple employees who enter standard General ledger journals. The controller wants to review these journal entries before they are posted. Currently, journals entries are posted without review.

You need to configure Dynamics 365 Finance to help set up a system led review process to meet the controller’s needs.

Which functionality should you configure?

- A . the controller’s security role so that he has approval privileges for General ledger journals

- B . an Advanced ledger entry workflow that uses the organizational hierarchy for journal posting, associated with the Advanced ledger journal name

- C . a Ledger daily journal workflow that uses the organizational hierarchy for journal posting, associated with the General ledger

- D . a manual journal approval with the journal assigned to the user group that the employees are assigned to

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

You plan to run several reports in USMF that list all the write-off transactions.

You need to replace the write-off reason used by the system for USMF to use a reason of “Bad debts.

To complete this task, sign in to the Dynamics 365 portal.

✑ Go to Navigation pane > Modules > Credit and collections > Setup > Accounts receivable parameters.

✑ Click the Collections tab.

✑ Click the Edit icon in the Write-Off section.

✑ Add a new Write-Off reason if it doesn’t exist.

✑ Tick the “Default” checkbox next to the new Write-Off reason.

✑ Click the Save button to save the changes.

A client is implementing accounts receivable in Dynamics 365 Finance.

You need to determine which requirements can be met by configuring the customer posting profile.

Which three requirements can be met? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

- A . Setting an interest code for a group of customers

- B . Specifying a receivable account for certain customers

- C . Setting terms of payment for a group of customers

- D . Setting the liquidity ledger account used for cash flow forecast

- E . Specifying a revenue account for sales orders transactions

A client has one legal entity and the following four dimensions configured: Business Unit, Cost Center, Department, and Division.

You need to configure the client’s system to run the trial balance inquiry in the General ledger module so that it displays the trial balance two ways:

• Include the main account and all four dimensions.

• Include the main account and only the business unit and cost center dimensions.

What should you configure?

- A . two account structures

- B . all financial dimensions by using the group dimension functionality

- C . two financial dimension sets

- D . two derived financial dimension hierarchies

A company plans to implement basic budgeting functionality in Dynamics 365 Finance. You need to configure the minimum number of components to enable functionality.

Which three required components should you configure? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

- A . Budget control rules

- B . Budget parameters and number sequences

- C . Financial dimensions for budgeting

- D . General ledger posting profiles

- E . Budget codes and budget models