Practice Free MB-310 Exam Online Questions

A company uses Microsoft Dynamics 365 Finance. You create revenue allocation schedules for items You need to link a revenue allocation schedule to an item.

Which two pages should you use? Each correct answer presents a complete solution NOTE: Each correct selection is worth one point.

- A . Item posting profile

- B . Charges group

- C . Released item

- D . item group

- E . Revenue allocation journal

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

You are managing credit and collections.

You need to set up mandatory credit limits for all customer documents.

Solution: Select the Balance + packing slip credit type in the Accounts receivable parameters form.

Select the Mandatory credit limit check box in the Customers form.

Does the solution meet the goal?

- A . No

- B . Yes

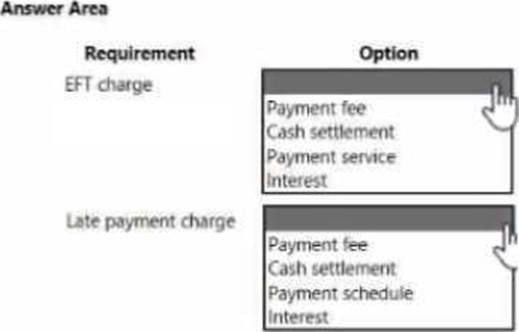

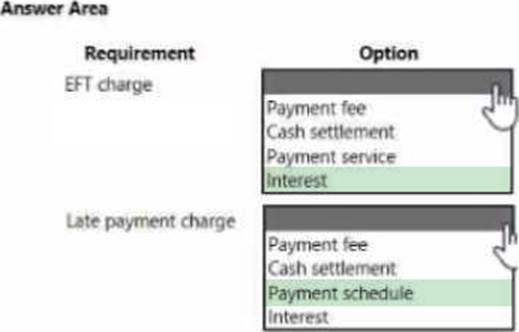

HOTSPOT

You are implementing Dynamics 365 Finance.

The company charges a convenience cost of $1S foe payments received from customers as an electronic fund transfer (EFT). The company also charges 10 percent interest on invoices that are not paid within the 30-day net terms

You need to configure the system

Which option should you configure? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point.

You need to address the employees issue regarding expense report policy violations.

Which parameter should you use?

- A . Validate expense purpose

- B . Pre-authorization of travel is mandatory

- C . Evaluate expense management policies

- D . Policy rule type

You need to adjust the sales tax configuration to resolve the issue for User3.

What should you do?

- A . Create multiple settlement periods and assign them to the US tax vendor.

- B . Create multiple sales tax remittance vendors and assign them to the settlement period.

- C . Run the payment proposal to generate the sales tax liability payments.

- D . Create a state-specific settlement period and assign the US tax vendor to the settlement period.

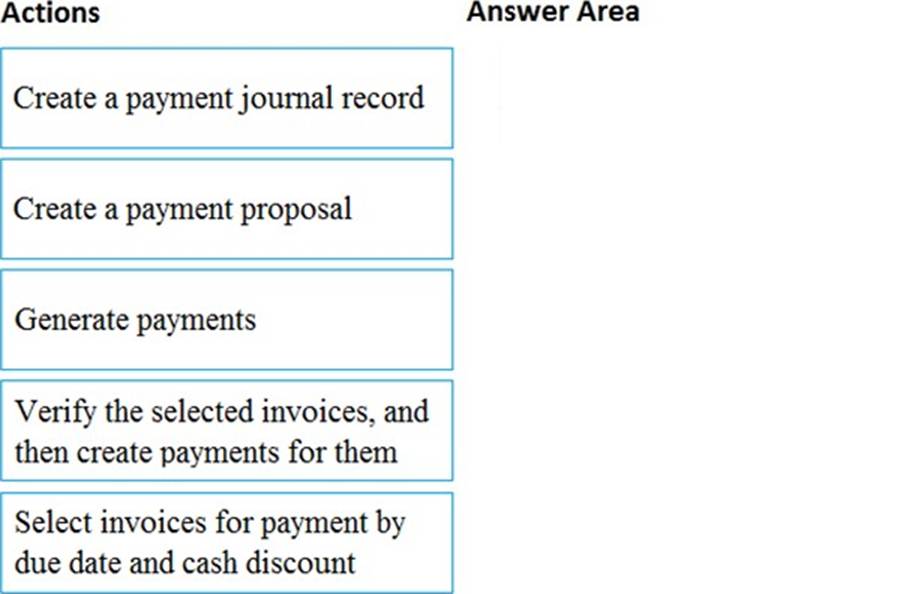

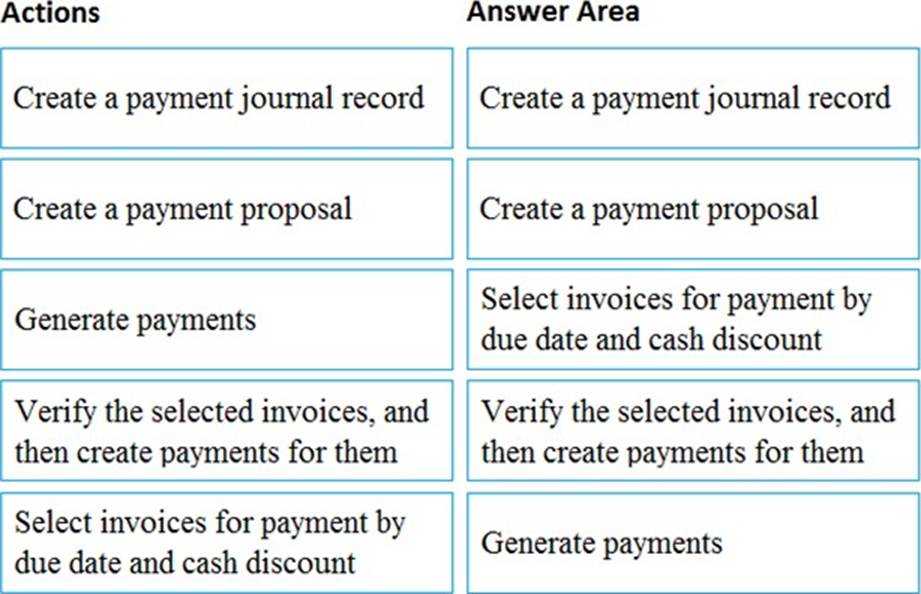

DRAG DROP

A company makes frequent payments to its vendors by using various due dates and discounts.

You need to set up and create a vendor payment by using a payment proposal.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/cash-bank-management/tasks/vendor-payment-overview

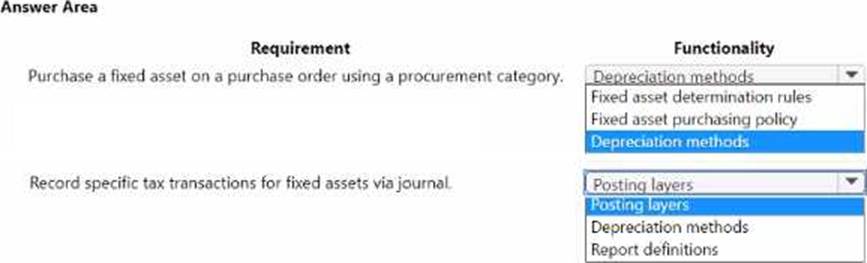

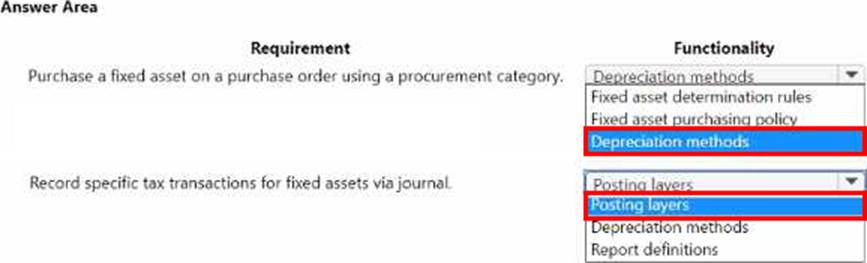

HOTSPOT

A company is implementing Dynamics 365 Finance.

The company purchases fixed assets using a purchase order. The company must post tax-specific transactions related to the fixed assets so the transactions can be reported separately.

You need to configure the system.

What should you configure? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point.

After you answer a question in this section, you will NOT be able to return to it As a result, these questions will not appear in the review screen.

A company is preparing to complete yearly budgets.

The company plans to use-pie Budget module in Dynamics 365 for Finance and Operations for budget management

You need to create the new budgets.

Solution: Create budget plans to define the revenues for a budget.

Does the solution meet the goal?

- A . Yes

- B . No

B

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/budgeting/budget-planning-overview-configuration

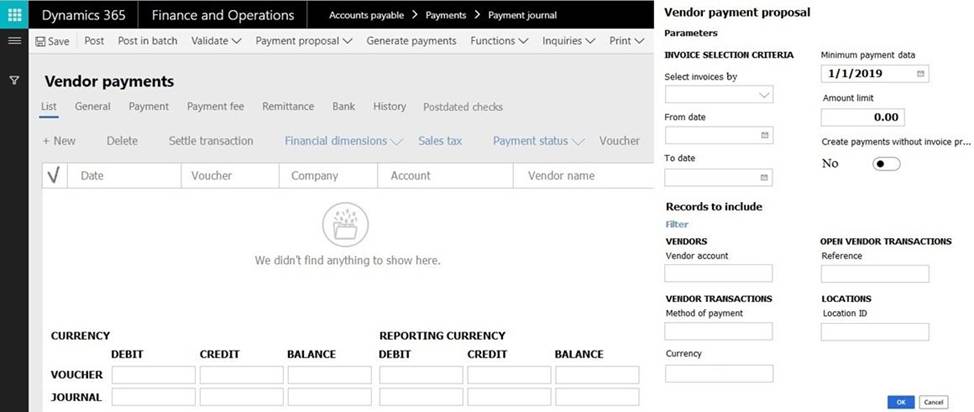

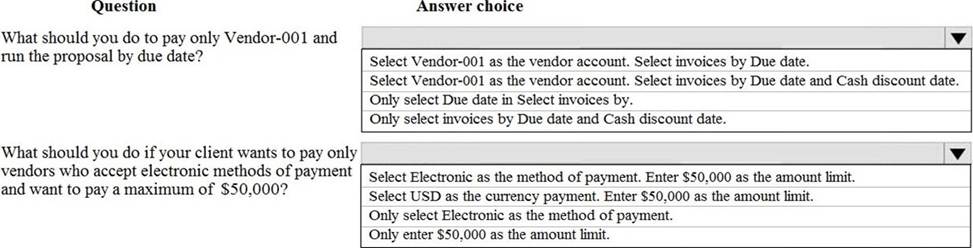

HOTSPOT

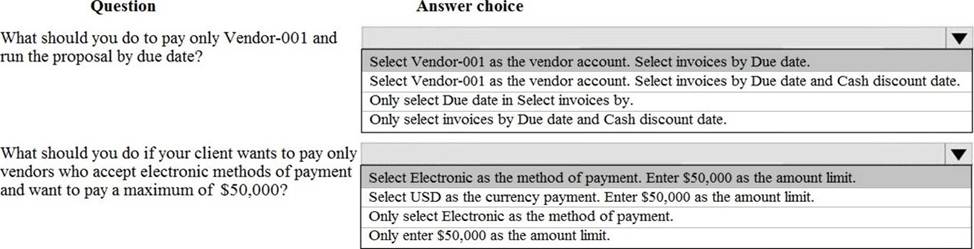

You are creating a payment proposal that shows invoices that are eligible to be paid.

You display the Accounts payable Payment proposal screen from the Accounts payable payment journal.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point.

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/accounts-payable/create-vendor-payments-payment-proposal

A company signs a four-year contract for an IT support project. The manager wants to know how the revenue amounts will be allocated across the four-year period. You need to implement a revenue schedule to determine the revenue amounts for each month.

Which setup should you use?

- A . 4 years

- B . 4 months

- C . 60 months

- D . 48 months