Practice Free MB-310 Exam Online Questions

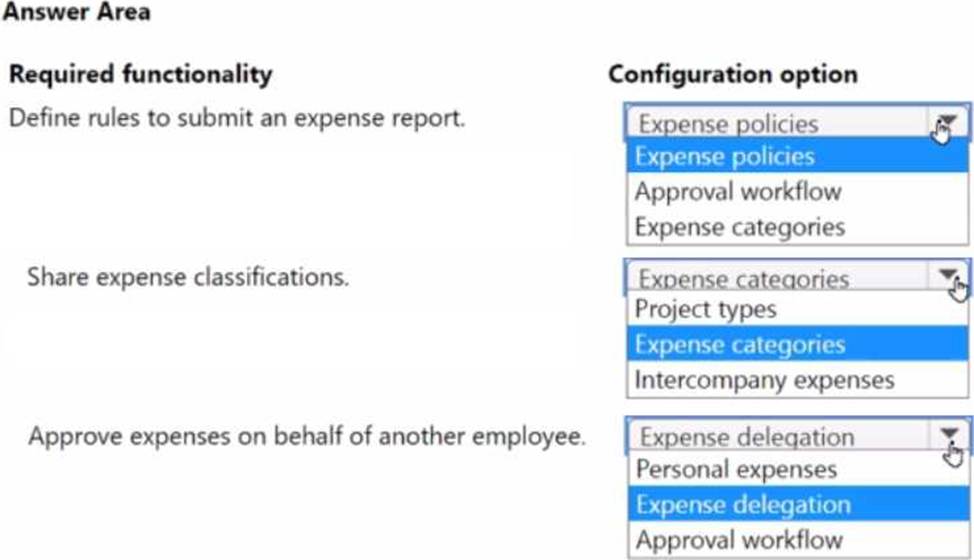

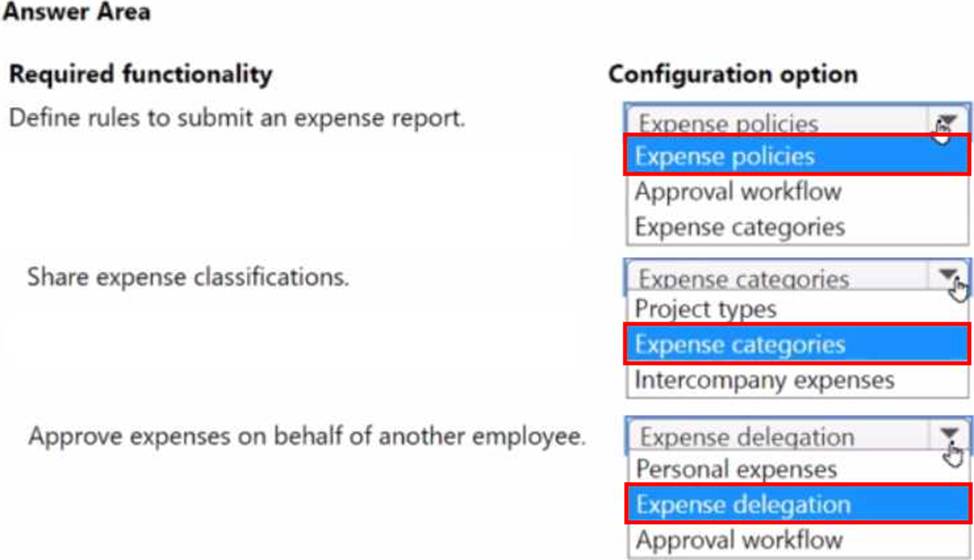

HOTSPOT

A company plans to implement expense management in Dynamics 365 Finance.

The finance manager requires the following functionality:

• Define rules that employees must follow to submit an expense report.

• Share expense classifications between expense management and project accounting.

• Approve expenses on behalf of another employee.

You need to recommend configuration options.

Which configuration options should you recommend? To answer, select the appropriate options in the answer area.

You are implementing Dynamics 365 Finance. You configure an invoice validation policy to use three-way matching and use a three percent tolerance for invoice totals.

A user enters a vendor invoice journal. The invoice validation policy is not applied.

You need to troubleshoot the policy.

What is the issue with the policy?

- A . Validation is only performed on vendor invoice entries.

- B . Validation is configured to check for price and quantity.

- C . Validation is only performed on invoice register entries.

- D . The tolerance percentage is too high.

You manage the ledger settlement process for a company in Dynamics 365 Finance. The company requires an improved settlement process.

You enable the Awareness between ledger settlement and year-end close feature to include only unsettled ledger transactions in the opening balance during the year-end process. The company must be able to settle transactions and handle realized gains and losses for foreign currency differences without any manual intervention. You need to configure the system to meet the requirements.

What should you do?

- A . Set up a new chart of accounts specifically for foreign currency transactions.

- B . Enable the Post foreign currency realized gains/losses for ledger settlements feature.

- C . Disable the Awareness between ledger settlement and year-end close feature.

- D . Ensure all transactions are posted within the same fiscal year before settling them.

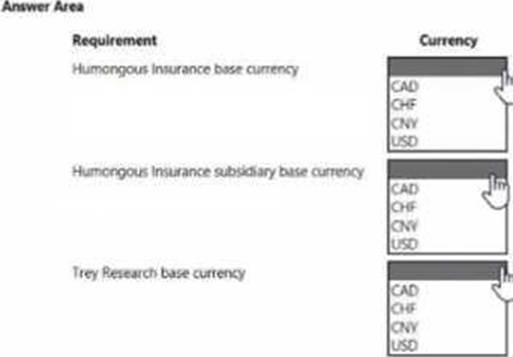

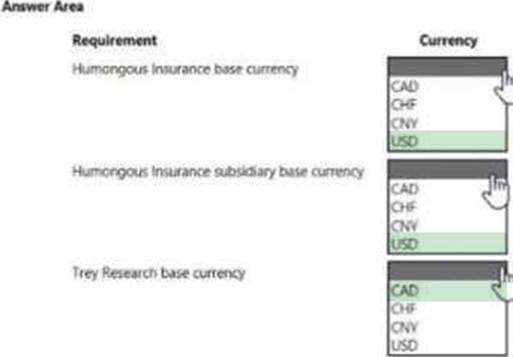

HOTSPOT

You need to configure currencies for the legal entities.

How should you configure currencies? To answer, select the appropriate options in the answer area. NOTE: Each correct selection is worth one point.

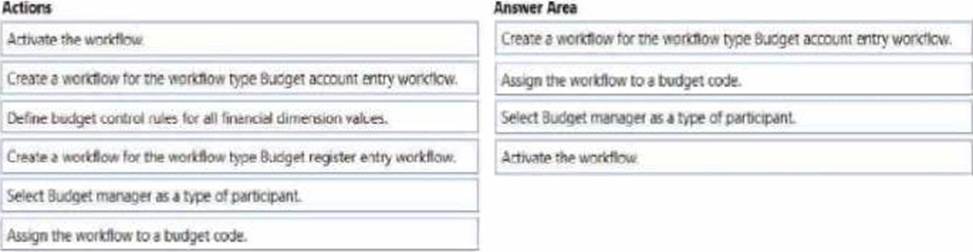

DRAG DROP

A company uses basic budgeting functionality in Dynamics 365 Finance.

A budget manager plans to review and approve budget register entries m the system.

You need to set up approval workflows.

Which four actions should you perform m sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them m the correct order.

You use Dynamics 365 Finance. Your company offers cash discounts. The discounts are offered sequentially to specific customers. Customers must pay their invoices within a specified time period.

The cash discounts are as follows:

• 5D10% – Cash discount of 10 percent when the amount is paid within 5 days.

• 10D5% – Cash discount of 5 percent when the amount is paid within 10 days.

• 14D2% – Cash discount of 2 percent when the amount is paid within 14 days.

Cash discounts can only be given if the payments are made within 10 days. You need to configure cash discounts.

What should you do?

- A . Create a new cash discount code of 14D10%.

- B . Create a new cash discount code of 10D14%.

- C . Delete the 14D2% cash discount code.

- D . Delete the 14D2% cash discount code from the next discount code list value of 10D5%.

You need to determine the cause of the issue that User1 reports.

What are two possible causes for the issue? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

- A . The account structure is in draft status.

- B . The account structure has quotations for all dimensions.

- C . User1 s security is incorrectly set up.

- D . The account structure has an asterisk for all dimensions.

- E . The financial dimensions were created in the incorrect legal entity.

An organization plans to set up intercompany accounting between legal entities within the organization.

Automatic transactions between legal entities must meet the following requirements:

✑ Provides systemwide integration and streamlining to save time

✑ Minimizes errors and create an audit trail with full visibility into business activities and transaction histories within the legal entities

You need to set up intercompany accounting and create pairs of legal entities that can transact with each other, clearly defining the originating company and the destination company.

Which three actions should you perform? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

- A . Select intercompany journal names.

- B . Configure intercompany accounting in both the originating entity and destination entity.

- C . Create intercompany main accounts to use for the due to and due from accounting entries.

- D . Define intercompany accounting setup by creating legal entity pairs defining originating and destination companies.

- E . Configure intercompany accounting in the destination entity only.

ACD

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/intercompany-accounting-setup

You are a Dynamics 365 Finance consultant.

You are currently unable to collaborate or track progress toward month-end close across legal entities in the current system.

You need to resolve the issue.

What should you configure?

- A . Financial reporting

- B . Financial insights workspace

- C . Electronic reporting

- D . Financial period close workspace

D

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/financial-period-close-workspace

A company plans to use Dynamics 365 Finance to calculate sales tax on sales orders.

You need to automatically calculate sales tax when the sales order is created.

Which three actions should you perform? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

- A . Assign values to the sales tax codes and assign the sales tax codes to the sales tax group associated to the customer.

- B . Assign all sales tax codes to the item sales tax group associated to the item being sold.

- C . Set up a default item sales tax group on the item being sold and set up a default sales tax group on the

customer used on the sales order. - D . Associate the sales tax jurisdictions to the item sales tax group associated to the item being sold.

- E . Set up a default sales tax code on the customer used on the sales order and set up a default item sales tax group on the item being sold.

ABE

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/indirect-taxes-overview