Practice Free MB-310 Exam Online Questions

HOTSPOT

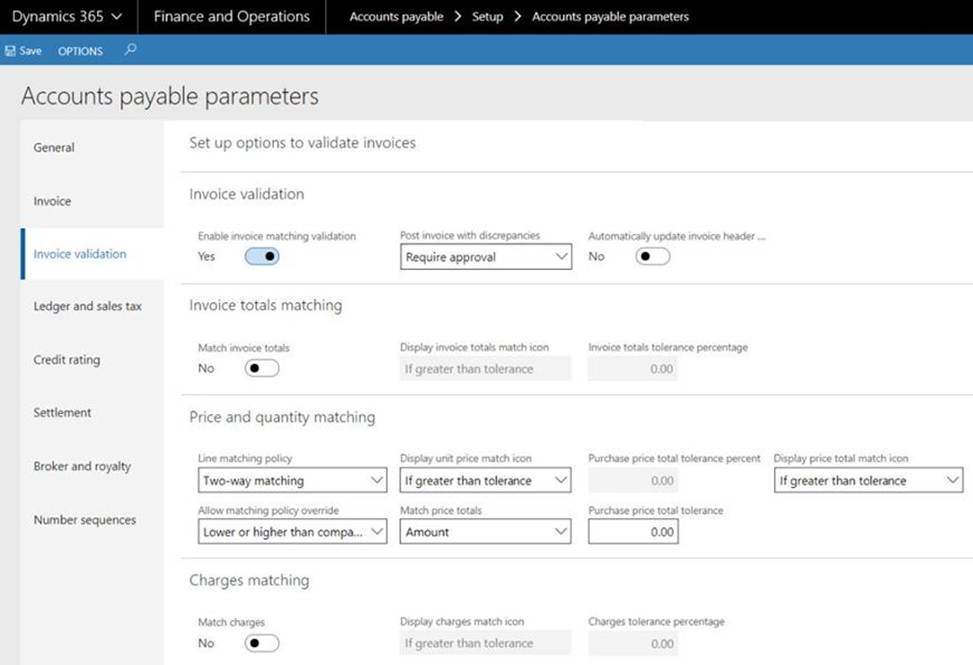

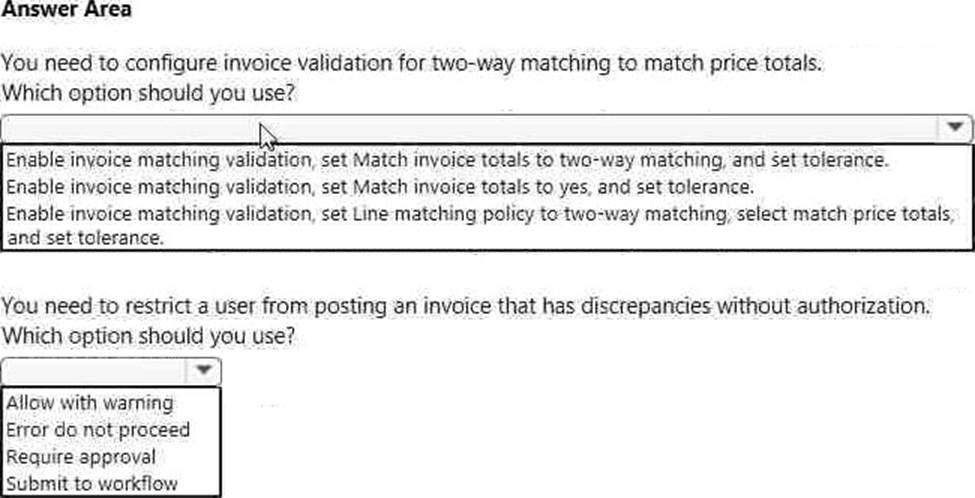

You need to configure invoice validation for vendors in Dynamics 365 for Finance and Operations. You are vie wing the Accounts payable parameter for Invoice validation.

Use the drop-down menus to select

the answer choice that answers each question based on the information presented

in the graphic. NOTE: Each correct selection is worth one point.

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/accounts-payable/tasks/set-up-accounts-payable-invoice-matching-validation

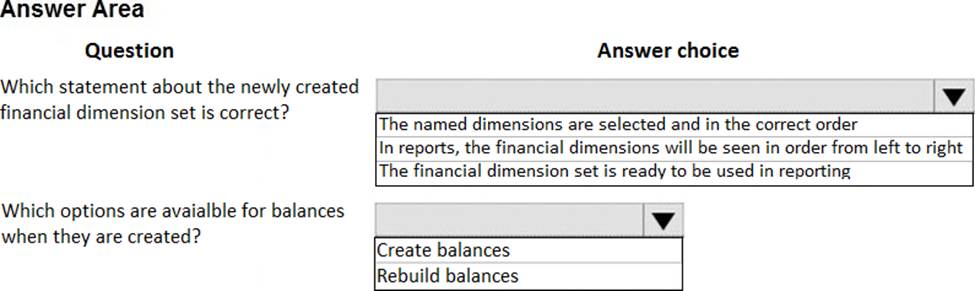

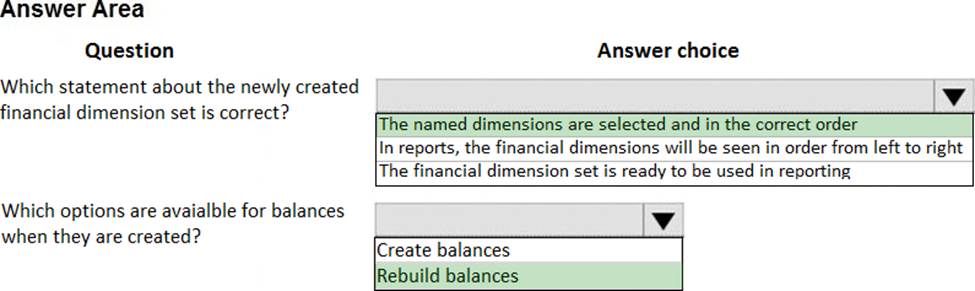

HOTSPOT

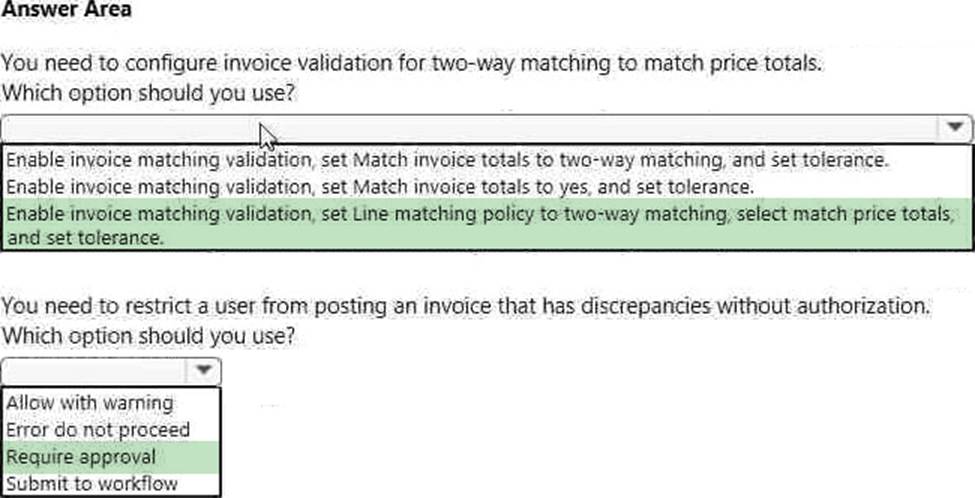

You Create a financial dimension set named MA + DEPT+PROJ as shown in the following screenshot.

The financial dimension set include the following dimensions:

• Main Account

• Department

• Project

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic. NOTE: Each correct selection is worth one point.

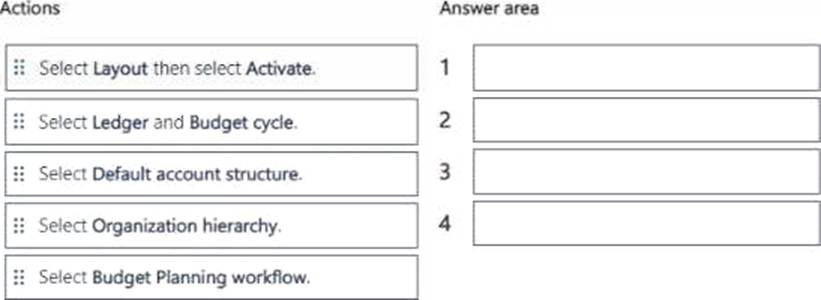

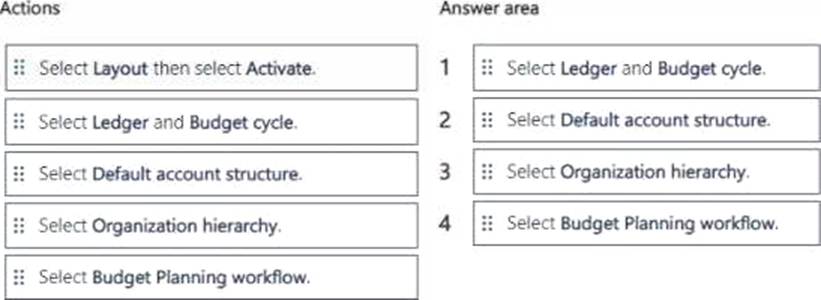

DRAG DROP

A company uses Dynamics 365 Finance to manage the budget planning process.

The company wants to create a new budget planning process while using the existing budget planning configuration.

You need to create and configure a working budget planning process.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

A client wants general journal to be used only to post ledger-type transactions.

You need to set up journal configuration to achieve the requirement.

Solution: Set up the journal control on the general to the account type of ledger.

Does the solution meet the goal?

- A . Yes

- B . No

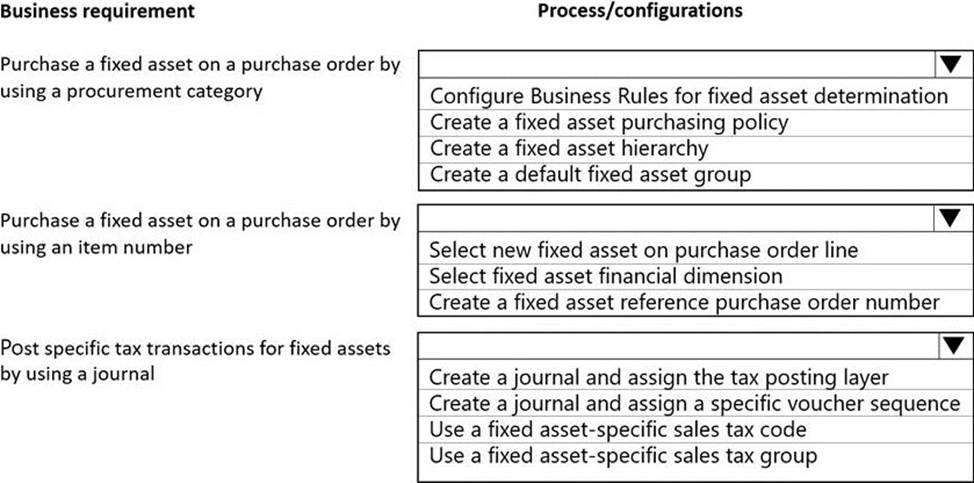

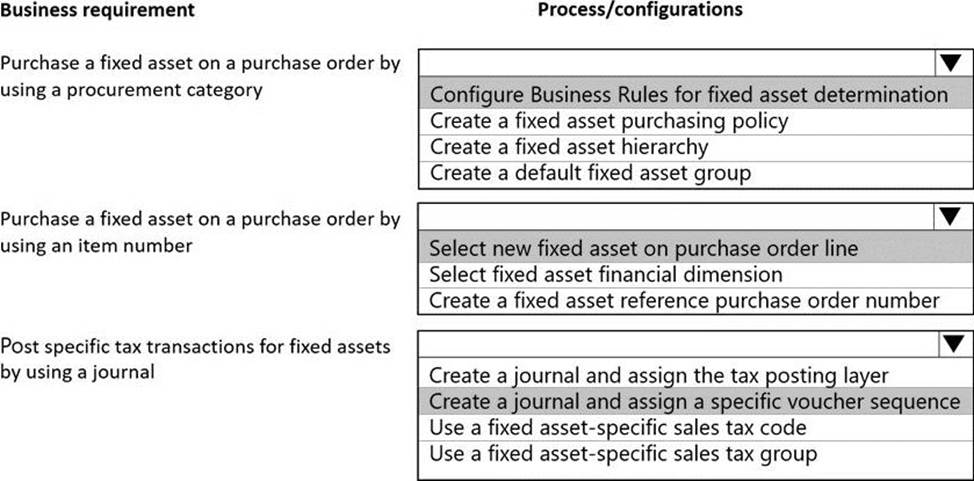

HOTSPOT

You manage fixed assets in Dynamics 365 Finance.

You have the following requirements:

✑ Purchase a fixed asset on a purchase order by using a procurement category.

✑ Purchase a fixed asset on a purchase order by using an item number.

✑ Post specific tax transactions for fixed assets by using a journal.

You need to associate process in the system with the corresponding business requirement.

Which actions should you perform? To answer, select the appropriate configuration in the answer area. NOTE: Each correct selection is worth one point.

Explanation:

Reference: https://www.loganconsulting.com/blog/fixed-asset-determination-rules-in-d365-for-finance-and-operations/

Topic 5, First Up Consultants

Overview

This is a case study Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam m the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section-To start the case study.

To display the first question in this case study, dick the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an AM Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question click the Question button to return to the question.

Background

First Up Consultants is a global finance and accounting company.

Financial needs at organizations ate constantly changing. When global companies become too large, it becomes too difficult for them to scale to meet then global operational needs. First Up Consultants provides "Finance as a Service’ capabilities.

Some large corporations complement their existing finance staff by engaging select services of First Up Consultants. Other large corporations outsource then entire finance operation to First Up Consultants.

First Up Consultants has hundreds of customers at any time. One such customer, humongous Insurance, is updating Its Dynamics Finance 365 implementation Another customer, Trey Research, is setting up its first Dynamics 365 Finance implementation.

Ledger

Humongous Insurance is a US-based company and operates its fiscal year from January 1 to December M. Humongous insurance reports across an its subsidiaries in consolidated financial reports. Trey Research is a Canadian-based company that operates its fiscal year from April 1 to March 31. Humongous Insurance employees receive an annual cost of living increase.

Requirements

• One of Humongous Insurance’s companies provides insurance to government clients and must separate that particular company into its owm subsidiary.

• The Humongous subsidiary will operate in China, which requires a fiscal year from February 1 to January 31. – Transitions must be posted in the business of record.

• Humongous insurance s subsidiary requires accounting entries to be posted from the subledger to the general ledger by 5:00 PM each day.

• Trey Research requires accounting entries to be posted from the subledger to the ledger immediately.

Taxes

• As part of the spinoff to a subsidiary, Humongous Insurance s subsidiaries taxes must be changed from US government rates to Chinese government rates.

• Humongous Insurance’s subsidiary must track use taxes that are not claimed or reported to the Chinese tax agency.

Fiscal calendars

You must create three new fiscal calendars

• A fiscal calendar named FebJan that runs from Feb 1 to Jan 31.

• A fiscal calendar named AprMar that runs from April 1 to March 31.

• A fiscal calendar named JanDec that runs from January 1 to December 31.

Accounts

• Trey Research most track bank account balances and transactions for each province in which it operates.

• The bank statement must be sent to the physical address of the home office.

Promotion

• Humongous insurance s subsidiary plans to celebrate its new subsidiary status by sending out free gifts to existing policy based on the Tier of their policy.

• Promotional Items are ordered for distribution and once received must be Tracked within Dynamics 365 Finance.

Reporting

• The CEO of Humongous Insurance needs to view the insurance products that customers plan to purchase. The report must show all transactions made over the last two years.

• The corporate vice president of Humongous Insurance s subsidiary needs to view the forecasted cash impact of specific products purchased. The report must show only new transactions.

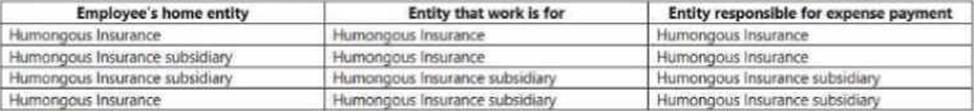

Expenses

Expenses must be pain using the following requirements:

Credit card processing

• Humongous Insurance requires all credit card transactions to include line-item details.

• Humongous Insurance’s subsidiary requires the shipping address merchant address, and lax information but cannot include any order line details.

• Trey Research requires all credit card transactions include transaction date, transaction amount, description, and line-item details.

Compliance and compensation

• Trey Research must be able to audit any modifications to its budget

• Humongow Insurance employees must receive raises tour times pet budget cycle.

You need to reconfigure the taxing jurisdiction for Humongous insurance’s subsidiary.

What should you do?

- A . Configure sales tax groups for transactions that occur in China.

- B . Configure dual currency support for sales fax

- C . Change the reporting currency.

- D . Change the sales tax settlement period authority

You need in BUI that captured employee mobile receipts automatic ally match the transactions to resolve the User1 issue.

Which feature should you enable?

- A . Show receipts during itemization

- B . Define expense policy for receipts

- C . Expense management workspace

- D . Expense reports re-imagined

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to implement a quarterly accruals scheme for USMF. The accrual scheme settings must match the settings of the monthly and annual accrual schemes.

To complete this task, sign in to the Dynamics 365 portal.

Create a quarterly accrual scheme with the same settings by using the following instructions:

✑ Go to Navigation pane > Modules > General ledger > Journal setup > Accrual schemes.

✑ Select New.

✑ In the Accrual identification field, type a value.

✑ In the Description of accrual scheme field, type a value.

✑ In the Debit field, specify the desired values. The main account defined will replace the debit main account on the journal voucher line and it will also be used for the reversal of the deferral based on the ledger accrual transactions.

✑ In the Credit field, specify the desired values. The main account defined will replace the credit main account on the journal voucher line and it will also be used for the reversal of the deferral based on the ledger accrual transactions.

✑ In the Voucher field, select how you want the voucher determined when the transactions are posted.

✑ In the Description field, type a value to describe the transactions that will be posted.

✑ In the Period frequency field, select how often the transactions should occur.

✑ In the Number of occurrences by period field, enter a number.

✑ In the Post transactions field, select when the transactions should be posted, such as Monthly.

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/create-accrual-schemes

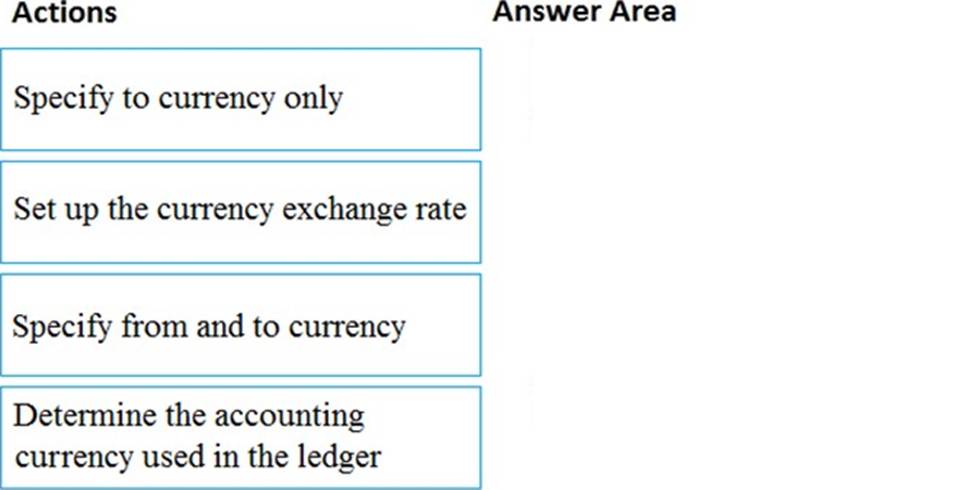

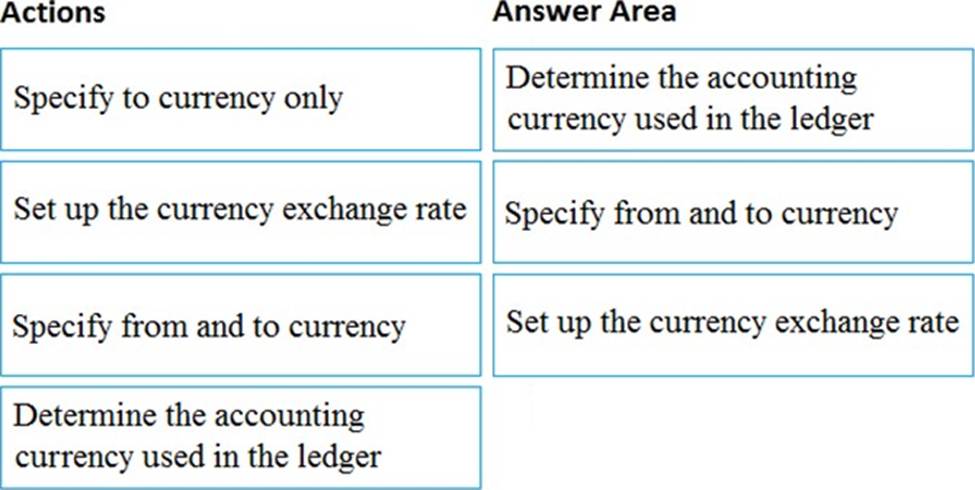

DRAG DROP

You are a consultant who is implementing Dynamics 365 Finance in your organization.

You need to set up currencies and exchange rates for a client.

Which three actions should you perform in sequence? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

A company uses Microsoft Dynamics 365 Finance to manage fixed assets. The company uses laptops ‘ex three years and then sells the laptops externally. You need 10 process laptop sales.

What should you do?

- A . Create a fixed asset disposal journal

- B . Create a sales order tor the sale of the asset.

- C . Use a free text invoke to record the sale

- D . Use an inventory movement journal to record the disposal.