Practice Free PEGACPDC25V1 Exam Online Questions

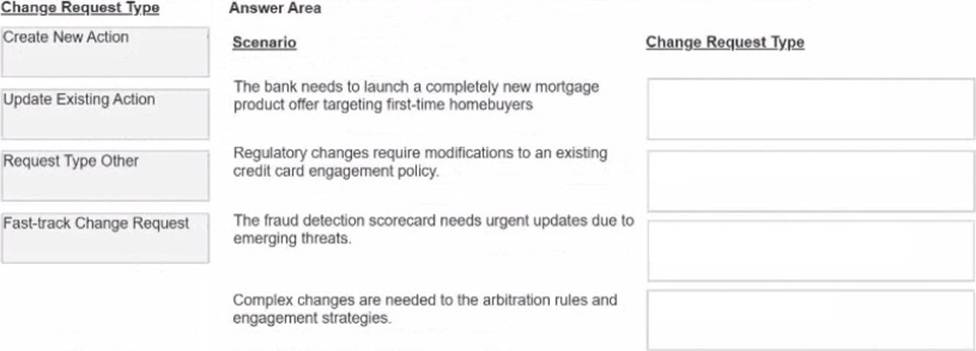

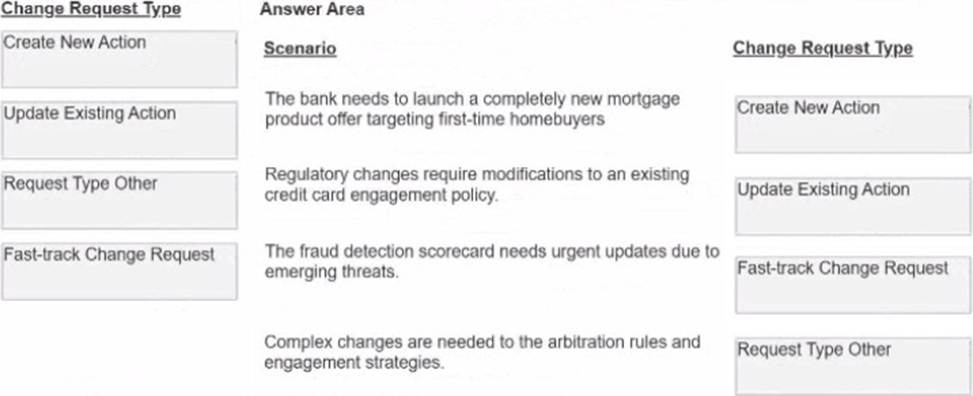

DRAGDROP

U+ BankT a retail bank, uses Pega Customer Decision Hub™ to manage various business changes throughout their operations The bank’s team members need to understand which change request type to use tor different business scenarios they encounter

Select each change request type on the left, and drag it to the matching scenario descriptions on the right:

U+ Bank observes that some customers receive the same credit card offer multiple times within a short period, which results in dissatisfaction. The bank wants to suppress a specific credit card offer if it has been shown three times within seven days.

What should you configure in the Contact Policy to prevent a specific credit card offer from being shown to a customer more than three times in seven days?

- A . Set the Tracking Level to Group and the Outcome Type to Impressions.

- B . Set the Tracking Level to Group and the Outcome Type to Clicks.

- C . Set the Tracking Level to Action and the Outcome Type to Impressions.

- D . Set the Tracking Level to Action and the Outcome Type to Clicks.

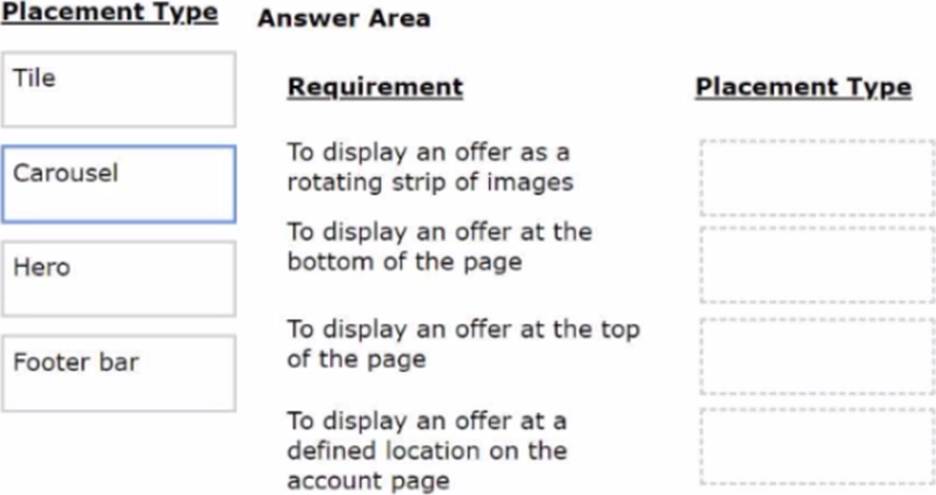

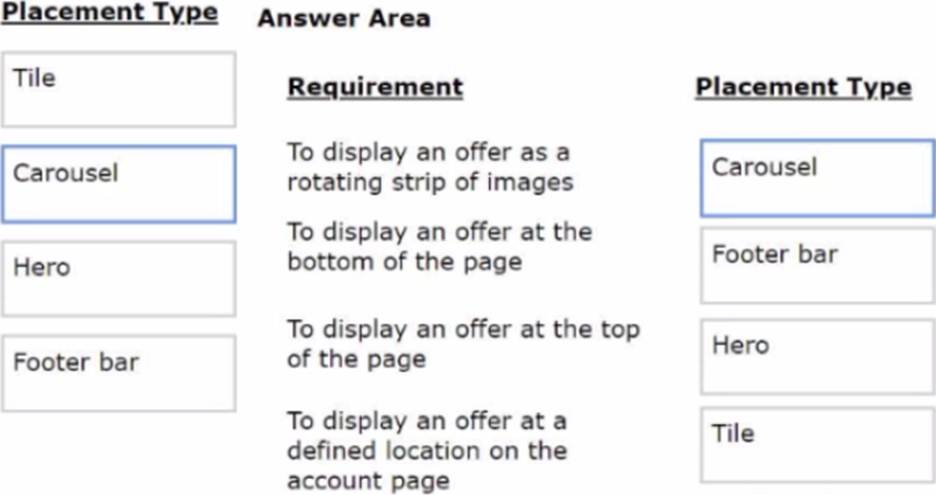

DRAGDROP

U+ Bank has decided to use the Pega Customer Decision Hub, M to recommend more relevant banner ads to its customers when they visit the personal portal.

Select each placement type on the left and drag it to the correct requirement on the right.

.

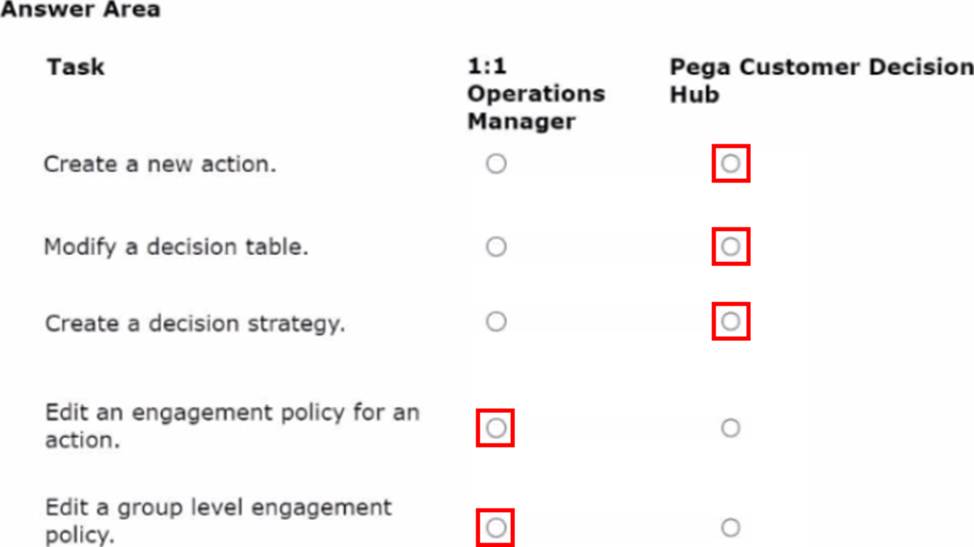

HOTSPOT

U+ Bank, a retail bank, uses the Business Operations Environment to perform its business changes. The bank carries out these changes in the Pega Customer Decision Hub portal by using revision management features or the 1:1 Operations Manager portal.

For each task, select the correct portal in which you initiate the change request based on best practices.

U+Bank presents various credit card offers to Its customers on Its website. The bank uses AI to prioritize the offers according to customer behavior. After the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

- A . Similar customers purchase other offers.

- B . Similar customers show interest in the offer.

- C . Similar customers ignore the offer.

- D . Similar customers do not qualify for the offer.

U+ Bank wants to use Pega Customer Decision Hub™ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website.

What three of the following artifacts are mandatory to implement this requirement7 (Choose Three)

- A . Customer engagement policies.

- B . An action and the associated web treatment.

- C . Real-time containers.

- D . Customer contact policies.

- E . A business structure.

B, C, E

Explanation:

To implement this requirement, you need to create an action and the associated web treatment, a real-time container, and a business structure. An action is a proposition that you want to present to a customer, such as a credit card offer. A treatment is the way you present the action to a customer, such as an image or a text message. A real-time container is a configuration that defines how to deliver actions and treatments to a specific channel, such as a website or a mobile app. A business structure is a hierarchy of business groups and business issues that organizes actions into meaningful categories. Verified Pega Academy – Decisioning Consultant – Creating actions and treatments, Pega Academy – Decisioning Consultant – Configuring real-time containers, [Pega Academy – Decisioning Consultant – Defining business structure]

A telecommunications company is promoting IPhone upgrades with unlimited data plans. The marketing team notices that a customer explicitly stated in a recent survey that they are not interested in iPhone products. The company wants to apply appropriate engagement policy conditions to respect customer preferences.

Which engagement policy condition type should you use to prevent iPhone offers for customers who express disinterest?

- A . Arbitration rules to deprioritize the customer segment.

- B . Suitability condition for customer empathy considerations.

- C . Applicability condition to respect customer preferences.

- D . Eligibility condition based on customer survey responses.