Practice Free IIA-CIA-Part2 Exam Online Questions

An internal auditor is assessing the organization’s risk management framework.

Which of the following formulas should he use to calculate the residual risk?

A)

![]()

B)

![]()

C)

![]()

D)

![]()

- A . Option A

- B . Option B

- C . Option C

- D . Option D

Which of the following would most likely form part of the engagement scope?

- A . Potential legislation on privacy topics will be employed as a compliance target.

- B . Wire transfers that exceeded $10,000 in the last 12 months will be analyzed.

- C . Both random and judgmental samplings will be used during the engagement.

- D . The probability of significant errors will be considered via risk assessment.

B

Explanation:

The engagement scope outlines the specific boundaries, focus areas, and activities that the internal audit will examine. The analysis of wire transfers exceeding $10,000 within a specified timeframe is a clear, specific task that defines what will be reviewed during the engagement, making it a typical element of an engagement scope.

IIA

Reference: IIA Standard 2220: Engagement Scope states that the scope must be sufficient to satisfy the engagement’s objectives and should outline specific areas and processes to be reviewed. Analyzing transactions over a certain threshold, like wire transfers exceeding $10,000, is a well-defined aspect of what the audit will cover.

An employee in the sales department completes a purchase requisition and forwards it to the purchaser. The purchaser places competitive bids and orders the requested items using approved purchase orders. When the employee receives the ordered items, she forwards the packing slips to the accounts payable department. The invoice for the ordered items is sent directly to the sales department, and an administrative assistant in the sales department forwards the invoices to the accounts payable department for payment.

Which of the following audit steps best addresses the risk of fraud in the cash receipts process?

- A . Verify that approvals of purchasing documents comply with the authority matrix.

- B . Observe whether the purchase orders are sequentially numbered.

- C . Examine whether the sales department supervisor approves invoices for payment.

- D . Determine whether the accounts payable department reconciles all purchasing documents prior to payment.

An employee in the sales department completes a purchase requisition and forwards it to the purchaser. The purchaser places competitive bids and orders the requested items using approved purchase orders. When the employee receives the ordered items, she forwards the packing slips to the accounts payable department. The invoice for the ordered items is sent directly to the sales department, and an administrative assistant in the sales department forwards the invoices to the accounts payable department for payment.

Which of the following audit steps best addresses the risk of fraud in the cash receipts process?

- A . Verify that approvals of purchasing documents comply with the authority matrix.

- B . Observe whether the purchase orders are sequentially numbered.

- C . Examine whether the sales department supervisor approves invoices for payment.

- D . Determine whether the accounts payable department reconciles all purchasing documents prior to payment.

An internal auditor is asked to review a recently completed renovation to a retail outlet.

Which of the following would provide the most reliable evidence that the completed work conformed to the plan?

- A . An interview with the employee who performed the work

- B . An analysis of purchasing and receiving documentation

- C . Existence of a signed completion document accepting the work

- D . A physical inspection of the retail outlet.

An internal audit activity has to confirm the validity of the activities reported by a grantee that received a charitable contribution from the organization.

Which of the following methods would best help meet this objective?

- A . Visiting the grantee to assess whether the execution of the project was in line with the defined grant scope.

- B . Verifying that the grantee’s final report is in line with what was depicted in the initial budget request.

- C . Reconciling general ledger accounts used by management of the area under review for reflecting expenses on charitable contributions.

- D . Interviewing employees of the corporate affairs department, which is responsible for charitable activities.

A

Explanation:

by a grantee that received a charitable contribution, the most effective method is to visit the grantee and directly assess whether the project execution aligns with the scope defined in the grant. This method provides firsthand evidence of the grantee’s activities and ensures that the charitable contributions are used as intended.

Detailed Explanation

IIA Standard 2310 C Identifying Information:

This standard requires that internal auditors gather sufficient, reliable, relevant, and useful information to achieve the engagement objectives. Visiting the grantee allows auditors to observe and verify the actual execution of the project, which provides the most direct and reliable evidence. Field Visits:

Conducting a site visit enables auditors to see the project in action, interview relevant personnel, and compare actual activities to what was promised in the grant proposal. This method helps ensure that the grantee is fulfilling its obligations and that the organization’s charitable funds are being used effectively.

Direct Evidence:

Direct observation of the grantee’s activities provides the highest level of assurance regarding the validity of the reported activities. This aligns with IIA’s emphasis on obtaining the best available evidence to support audit findings.

Why Not Other Options?

Option B (Verifying final report vs. initial budget): This only compares reports, which might not accurately reflect the actual activities conducted by the grantee.

Option C (Reconciling general ledger accounts): This focuses on financial records, which may not provide sufficient detail about the actual activities conducted.

Option D (Interviewing corporate affairs employees): While informative, this method only provides secondhand information and does not directly verify the grantee’s activities.

Conclusion: Option A is correct because visiting the grantee provides the most reliable and direct evidence that the activities are in line with the grant’s defined scope, ensuring the validity of the grantee’s reported activities.

Which of the following is one of the five attributes that internal auditors include when documenting a deficiency?

- A . The criteria used to make the evaluation

- B . The methodology used to analyze data

- C . The proposed follow-up engagement work to be performed

- D . The scope of work performed during the engagement

An engagement supervisor reviewed a staff internal auditor’s documentation and noted that several edits should be made. The internal audit activity uses an electronic workpaper database and does not maintain paper files for its system of record. A system error prevents the engagement supervisor from adding her electronic signature to any workpaper in the database.

Given this situation which is the most appropriate response to provide evidence of supervisory review?

- A . The engagement supervisor should print sign and date each workpaper after the review is complete and scan the document into the database as evidence of review

- B . Because the engagement supervisor called the help desk to correct the IT problem, he should upload the support-request ticket from the help desk to serve as evidence of the review

- C . The engagement supervisor should ask another manager-level internal auditor not associated with the project to sign the workpaper on his behalf

- D . The engagement supervisor should instruct the staff internal auditor to add a note in the workpaper on his behalf indicating that the workpaper was reviewed and feedback was provided

A manufacturer is under contract to produce and deliver a number of aircraft to a major airline. As part of the contract, the manufacturer is also providing training to the airline’s pilots. At the time of the audit, the delivery of the aircraft had fallen substantially behind schedule while the training had already been completed.

If half of the aircraft under contract have been delivered, which of the following should the internal auditor expect to be accounted for in the general ledger?

- A . Training costs allocated to the number of aircraft delivered, and the cost of actual production hours completed to date.

- B . All completed training costs, and the cost of actual production hours completed to date.

- C . Training costs allocated to the number of aircraft delivered, and 50% of contracted production costs.

- D . All completed training costs, and 50% of the contracted production costs.

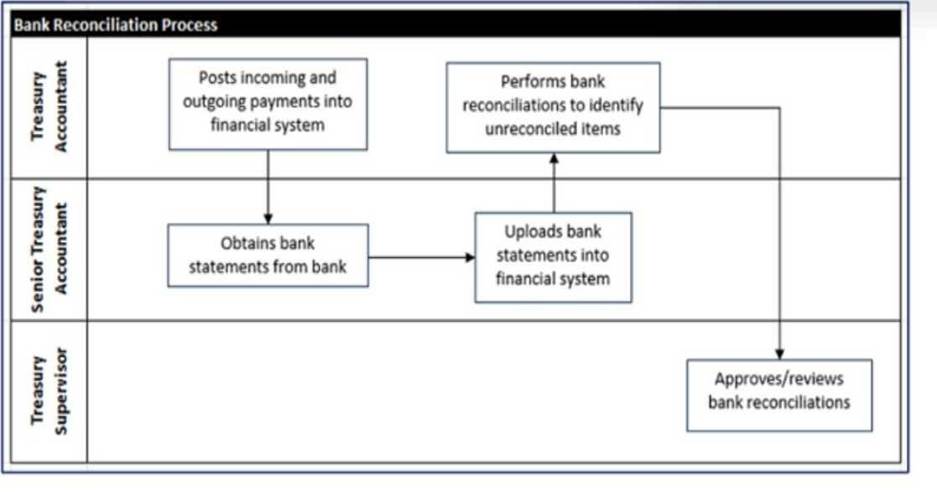

Below is a flowchart detailing an organization’s bank reconciliation process.

Which of the following conclusions can be drawn from the flowchart?

- A . There is a conflict in the segregation of duties between preparing bank reconciliations and posting payments to the accounting books.

- B . There is an appropriate segregation of duties in the treasury department during the bank reconciliation process.

- C . There is a large workload for the treasury accountant during the bank reconciliation process.

- D . Bank statements should be obtained at a higher level, such as through the treasury supervisor.

B

Explanation:

The flowchart indicates that different individuals are responsible for various stages of the bank reconciliation process. The Treasury Accountant posts payments and performs reconciliations, while the Senior Treasury Accountant obtains and uploads bank statements, and the Treasury Supervisor approves/reviews the reconciliations. This segregation of duties ensures that no single individual has control over all aspects of the financial transaction process, which helps in preventing errors and fraud.

Reference: The Institute of Internal Auditors (IIA), International Standards for the Professional Practice of Internal Auditing (Standards)

"Auditing and Assurance Services" by Alvin