Practice Free FPC-REMOTE Exam Online Questions

All of the following statements about the implementation of department processes are true EXCEPT:

- A . Each team member has a clear and concise assignment.

- B . A backup manager is identified and participating in the project.

- C . The standards for measuring success must be clear and specific.

- D . Managers who delegate properly have less time to focus on work.

D

Explanation:

Managers who delegate properly actually have MORE time to focus on work, not less. Delegation improves efficiency and productivity by allowing managers to focus on strategic tasks.

Options A, B, and C are correct as they are key to successful implementation of processes.

Reference: Payroll Process Best Practices (Payroll.org)

The DOL can issue fines for all the following violations EXCEPT:

- A . Overtime

- B . Sick Leave

- C . Child Labor

- D . Minimum Wage

B

Explanation:

The Department of Labor (DOL) enforces violations related to:

Overtime (A) C Under the Fair Labor Standards Act (FLSA).

Child Labor (C) C Protecting workers under age 18.

Minimum Wage (D) C Enforcing the federal minimum wage.

Option B (Sick Leave) is incorrect because the DOL does not regulate paid sick leave at the federal level. Sick leave laws vary by state, but there is no federal mandate requiring paid sick leave.

Reference: FLSA C Wage and Hour Division (DOL) Enforcement

Payroll.org C Federal and State Payroll Compliance

Which of the following circumstances would cause a breach of confidentiality?

- A . Furnishing payment history on a written authorization to a mortgage company

- B . Providing benefit election information to an employee’s spouse

- C . Sharing general ledger costing data with the accounting department

- D . Supplying payroll records to the company’s legal department

B

Explanation:

Payroll confidentiality ensures employee information is only disclosed with proper authorization.

Option A (Payment history with written authorization) is NOT a breach because the employee provided consent.

Option C (General ledger costing shared with accounting) is NOT a breach since accounting requires financial data for compliance.

Option D (Payroll records to legal department) is NOT a breach as legal teams need data for investigations.

Option B (Providing benefit election information to a spouse) is a breach unless the employee has explicitly authorized their spouse to receive this information.

Reference: Payroll.org C Payroll Data Privacy Guidelines

HIPAA & Confidentiality in Payroll Recordkeeping

Under the FMLA, employers MUST maintain related leave records for how many years?

- A . 1

- B . 3

- C . 4

- D . 5

B

Explanation:

The Family and Medical Leave Act (FMLA) requires employers to keep FMLA-related records for at least 3 years.

These records include:

Employee leave requests

Employer responses

Payroll and benefits records

Medical certifications

The DOL may audit these records to ensure FMLA compliance.

Reference: FMLA Recordkeeping Requirements (DOL)

Payroll Record Retention Guidelines (Payroll.org)

Which of the following forms is used to report federal income tax withheld from payments to an independent contractor?

- A . Form 940

- B . Form 941

- C . Form 944

- D . Form 945

D

Explanation:

Form 945 is used by employers to report federal income tax withholding from non-payroll payments, including payments to independent contractors if subject to backup withholding.

Option A (Form 940) is incorrect because Form 940 reports federal unemployment taxes (FUTA). Option B (Form 941) is incorrect because it is used for employee payroll tax reporting. Option C (Form 944) is incorrect because it is used for small employers filing annually.

Reference: IRS Form 945 Instructions

Payroll.org C Independent Contractor Withholding Rules

Based on the following Section 125 Cafeteria Plan contributions, calculate the employee’s biweekly deductions.

- A . $69.61

- B . $75.42

- C . $77.69

- D . $82.92

A

Explanation:

Health Insurance (Biweekly) = ($1,500 ÷ 26) = $57.69

Life Insurance (Biweekly) = ($15 × 12 ÷ 26) = $6.92

Dental Insurance = $5.00

Total Biweekly Deduction = $57.69 + $6.92 + $5.00 = $69.61

Reference: IRS Section 125 Cafeteria Plan Rules

The FLSA is enforced by which of the following entities?

- A . DOL

- B . ICE

- C . IRS

- D . SSA

A

Explanation:

The Fair Labor Standards Act (FLSA) is enforced by the Department of Labor (DOL) through its Wage and Hour Division (WHD).

ICE (Immigration and Customs Enforcement) handles immigration-related work issues, not wage enforcement.

IRS (Internal Revenue Service) enforces tax laws, not labor standards.

SSA (Social Security Administration) manages Social Security benefits, not wage laws.

Reference: FLSA Compliance and Enforcement (DOL)

Payroll Compliance Guidelines (Payroll.org)

During open enrollment, the employee elects the following deductions.

What is the total of the Section 125 Cafeteria Plan deductions?

- A . $70.00

- B . $75.00

- C . $100.00

- D . $175.00

A

Explanation:

Section 125 Cafeteria Plan deductions include only pre-tax health and dental insurance contributions.

Eligible Pre-Tax Deductions:

Health Insurance Premiums: $50.00

Dental Insurance Premiums: $20.00

Total Section 125 Deductions: $70.00

Non-Eligible Deductions:

Charitable Contributions ($5.00) → Not pre-tax.

457(b) Deferral ($100.00) → Retirement savings, not a Section 125 deduction.

Thus, the correct answer is A. $70.00.

Reference: IRS C Section 125 Cafeteria Plan Guidelines

Payroll.org C Employee Benefit Deduction Compliance

Under the CCPA, use the following information to calculate the MAXIMUM child support order deduction allowed for an employee supporting a second family and in arrears.

- A . $689.00

- B . $768.90

- C . $838.80

- D . $908.70

B

Explanation:

Under the Consumer Credit Protection Act (CCPA):

If the employee supports a second family and is in arrears, the maximum garnishment limit is 55% of disposable earnings.

Calculate Disposable Earnings:

Gross wages: $1,573.00

Less taxes withheld: $175.00

Disposable earnings = $1,573.00 – $175.00 = $1,398.00

Calculate Maximum Child Support Deduction (55% of disposable earnings):

$1,398.00 × 55% = $768.90

Thus, the correct answer is

B. $768.90.

Reference: U.S. Department of Labor C CCPA Garnishment Rules

Payroll.org C Child Support Withholding Guidelines

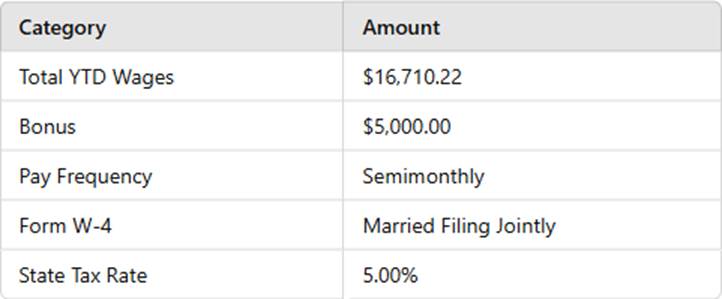

An exempt employee is being paid an annual discretionary bonus. The employee has submitted a 2020 W-4.

Calculate the net pay based on the following information:

- A . $3,117.50

- B . $3,267.50

- C . $3,603.40

- D . $3,932.83

B

Explanation:

Using the IRS Supplemental Wage Method, the flat tax rate of 22% applies to bonuses:

Federal Income Tax:

$5,000 × 22% = $1,100.00

Social Security Tax:

$5,000 × 6.2% = $310.00

Medicare Tax:

$5,000 × 1.45% = $72.50

State Income Tax:

$5,000 × 5.0% = $250.00

Total Taxes Withheld: